TL;DR:

When buying properties on the secondary market or those properties not owned by reputable real estate developers, you first have to make sure that the seller is 110% legit before you even give a centavo. Due diligence is the process of finding out if the seller is 110% legit. This should be obvious, but to some, it isn’t. This is what motivated me to write this piece.

The Story

There were two funny events that happened this week concerning due diligence, that I’d like to share with you.

On the first event, our brokerage was on the buying side. The seller of the property insisted that our buyer provide first a down payment BEFORE we could conduct a due diligence.

For the second event, our brokerage was on the selling side. This time, the buying party wanted our seller to basically do the due diligence on himself; submit the Certified True Copies of the Title and Tax Declaration to them (buyer’s party).

Now, before I tell you the mistakes in the above mentioned events, please understand that different brokerages have different policies concerning due diligence so, I would like to explicitly inform you that the views and opinions contained herein are my own.

Alright. Now that we have that cleared up, here’s the mistake or red flag in the first event:

When buying properties on the secondary market (secondary market are those for sale properties that are no longer owned by developers) you should never, in any instance, transfer money or pay a reservation fee or down payment if you have not yet verified the authenticity of the ownership of the seller.

In simple terms: you do not part with your hard earned money if you have not made sure that the full name of the seller is the same one written in the Title and that the Title presented to you is similar to the the copies held by the condo/subdivision administrator and Land Registration Authority/Registry of Deeds.

Explain-To-Me-Like-Im-Five? Don’t give money to that wo/man if you’re not 110% sure that s/he is the owner of the property.

There are scammers who could produce a fake Title and have you fooled! This is the reason why you need to know basics of due diligence so you would not be victimized.

For the second event, the mistake was asking the seller to do due diligence on himself.

The legitimate seller possess the Owner’s Copy of the Title, it is the buyer or his party that needs to conduct due diligence to verify the legitimacy of the said Title.

It is the buyer’s or his/her broker’s responsibility to personally request and receive the Certified True Copies of the Title and Tax Declaration from the government agencies. In the normal course of a sales transaction, it would be quite irresponsible for a buyer or his/her broker to blindly trust a seller into providing these important documents, as it may easily be forged, faked or counterfeited.

The Due Diligence

Investopedia defines due diligence as,

“an investigation, audit, or review performed to confirm facts or details of a matter under consideration.”

In real estate, due diligence involves the scrutiny of real estate related documents before paying a fee or signing a contract.

There are five (5) simple steps to do the due diligence, but before you proceed, please inform the seller that you will be conducting the said due diligence and ask for his/her permission. Both of you should be on the same page. If the seller forbids you or has a violent, negative reaction towards the conduct of a due diligence, then, it would be prudent to cancel or not move forward with the transaction.

If seller is okay, here are the steps:

1. Request for a photocopy/digital copy of the Title, Tax Declaration and Updated Real Property Tax Official Receipt from the seller.

The Real Property Tax will help determine if the seller has properly paid his/her property tax. Furthermore, this will aid you in acquiring a Tax Clearance from the City / Municipal Treasurer’s Office. Please make sure to inform the seller that you will be getting a Tax Clearance.

2. (If applicable) Go to the condominium or subdivision administration office and verify with the building or subdivision manager if the name of the person written in the Title given to you is the same in their record as the owner of the specific property.

The name in the Title should match the name in their record, else, that would be a red flag.

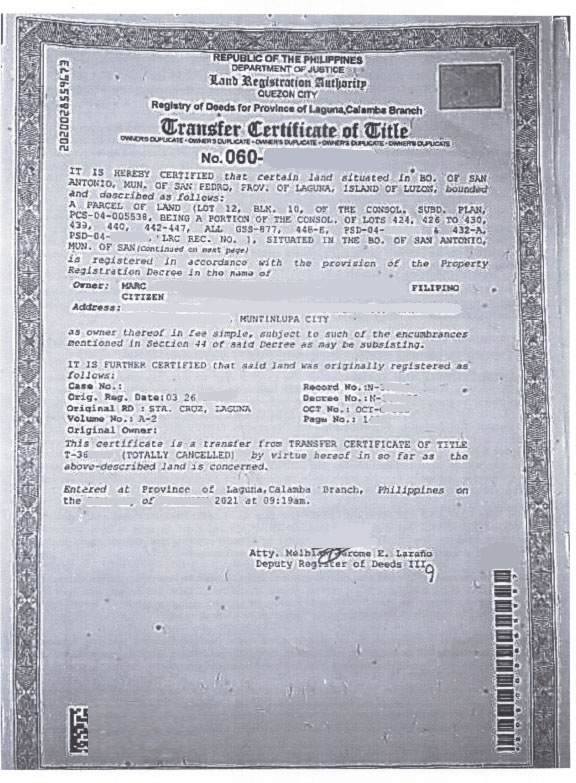

3. Go to the Land Registration Authority or Registry of Deeds and request for a Certified True Copy of the Title. They will ask for the details of the Title, so your photocopy/digital copy will come in handy. The name, number and other details in the photocopy/digital copy of the Title given to you should match the Certified True Copy that the Registry would provide, or else, another red flag!

In our experience, you do not need a Special Power of Attorney to request for this. All you need is a photocopy/digital copy of the Title or even just the Title number.

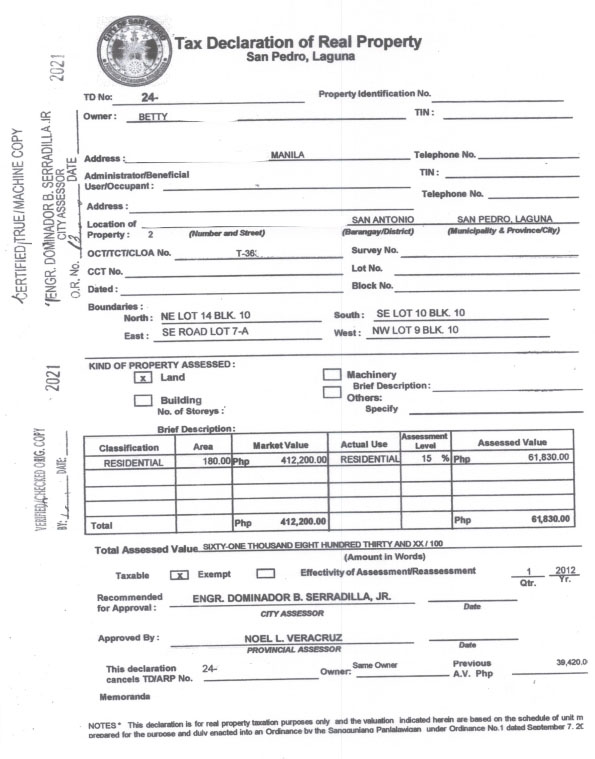

4. Go to the Assessor’s Office and request for a Certified True Copy of the Tax Declaration.

Depending on the Assessor’s Office, some would require a copy of the Real Property Tax Clearance Official Receipt (and other documents), while other offices won’t. In Alabang for example, the Assessor’s Office would require you to have an Authorization Letter from the seller to request for a Certified True Copy. Check the website of the Assessor’s Office where the property is located to learn their exact requirement/s.

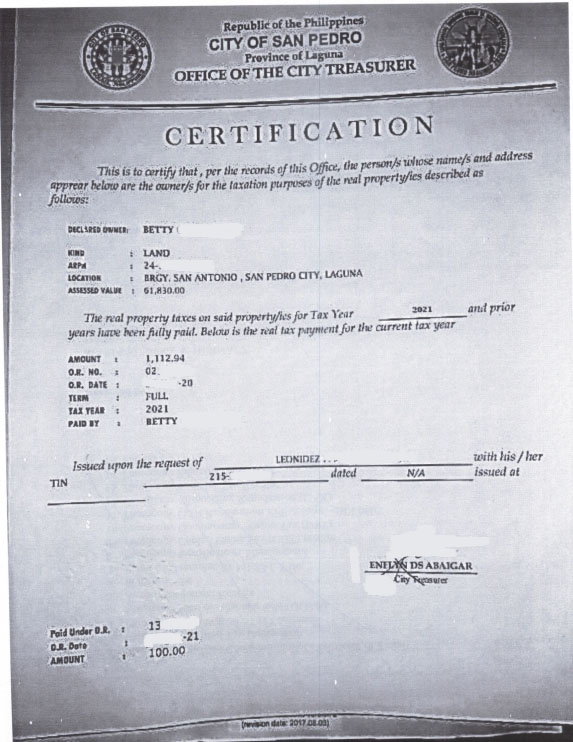

5. Go to the City / Municipal Treasurer’s Office and request for a Tax Clearance. They would require a copy of the Updated Real Property Tax Official Receipt.

In most cases, the Tax Clearance should be provided by the seller but, for convenience and peace of mind of the buyer, our brokerage includes this as part of the due diligence. Again, based from our experience, there is no need for a Special Power of Attorney to request for this.

6. That’s it! You’re done with your due diligence!

If the name of the seller matches the name in the records of the building/subdivision admin, Registry of Deeds and Assessor’s Office, you can confidently conclude that s/he is the legitimate seller.

Done properly and without incidents (like fire, flood, pandemic), it should take you as fast 7 days to complete the entire process.

Here are the guides in acquiring the Certified True Copy of the Title, Tax Declaration and Tax Clearance.

Land Registration Authority – Certified True Copy of Property Title

- Visit any registry of deeds in the country near you

- Fill-out Information Request Form. Provide the following:

- Title Number

- Full name of registered owner

- Area of the Registry of Deeds where the Title is registered (i.e. Registry of Deeds For Quezon City. This info is located at the top of the Title)

- Bring valid government ID’s

- Pay the processing fee

- Get the Official Receipt. You will have to present this to claim the Certified True Copy.

Here are the location of that you could visit:

1 Central Office: East Avenue cor. NIA Road, Diliman, Quezon City

City / Municipal Assessor’s Office – Certified True Copy of Tax Declaration

Each City or Municipal Assessor’s Office have varying procedures and fees for obtaining a Certified True Copy of the Tax Declaration.

The usual documentary requirement would be the Current Real Property Tax Clearance Official Receipt, but it best that you double check the website of the Assessor’s Office where the property is located.

Here are a few examples:

- Fill out and submit ARMD Form 1,

- Pay the processing fee. Ranges from ₱50 for a personal copy and ₱70 for BIR purposes,

- Present Official Receipt and receive a “claim number”,

- Wait for claim number to be called,

- Receive the Certified True Copy.

- Fill out the request slip from the City Assessor’s Office,

- Pay the required fee of ₱100 and ₱15 for the documentary stamp,

- Present the Official Receipt of payment to the Assessor’s staff,

- Receive the Certified True Copy.

Note: They require a photocopy of the Title or photocopy of the Tax Declaration and copy of the updated Real Property Tax Payment.

- Present a written request to the clerk at the Municipal Assessor’s Office,

- Proceed to the Municipality Treasurer’s Office for the payment; ₱100 for the required fee and ₱15 for the documentary stamp,

- Present the Official Receipt of payment to the Municipal Assessor’s Office,

- Receive the Certified True Copy.

Note: They require the Current Tax Receipt.

- Submit a request for the issuance of the Certified True Copy of the Tax Declaration together with the documentary requirement,

- Fees to pay: Certification Fee – ₱90/ Real Property Unit (RPU). Certified True Copy – ₱90/RPU for personal file. ₱180/RPU for bank or loan purposes,

- Receive the Certified True Copy.

City / Municipal Treasurer’s Office – Tax Clearance

Similar to getting a Certified True Copy of the Tax Declaration, the process of acquiring a Tax Clearance could differ from place to place. It’s best that you check the website of the Treasurer’s Office where the property is located.

Two examples:

Requirement – Updated Real Property Tax Official Receipt

- Present Updated Real Property Official Receipt,

- Pay ₱100,

- Receive the Tax Clearance.

Requirement – Updated Real Property Tax Official Receipt

- Present latest Official Receipt and wait for the request to be processed. Person in charge will print and review entries then advise you to get the official receipt for tax clearance,

- Pay ₱50,

- Receive the Tax Clearance.