You can skip the intro and scroll down to the Tax Chart.

First time Philippine real estate buyer or seller? Yes? Then before we proceed let me first congratulate you on the sale! We’re in a tough 2021 market right now and I’m happy that you made the deal push through.

No? That’s alright. I will still be happy to share with you this knowledge.

I made this as a basic piece to hopefully guide you & everybody else that’s interested on the things to do after the sale. Be warned though, the ‘after-sale’ road is full of bumps, so be prepared.

From experience, we noticed that the process of paying the taxes and transferring the Title have nuanced differences from city to city, so use this article as a rough guide and not a strict manual (or at the very least, a starting point, in your after-sale journey).

To add a quick disclaimer: There is also the possibility that by the time you have read this, the tax rates, fees or the process itself have already changed, so double check with other sources if possible.

The write-up below may seem like a big wall of text but don’t be intimidated. I have tried to make it as easy to read as possible. Tried.

I also included photos of actual documents for your easy reference.

Let’s begin!

Now that you’ve bought or sold a Philippine real estate property, you would need to know the taxes and fees to pay and the process of transferring the Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT). From hereon, let’s just call it “Title”.

Side Note: This is also helpful to the new or future real estate brokers that would like to provide “Title Transfer” services to their clients. Here in the Philippines, there is no law that would require independent real estate brokerages, brokers or agents to transfer the Title to their client’s name after a successful sale.

In usual transactions, the selling broker would help the seller pay the 6% Capital Gains Tax for free while the buying broker is not required to do the Title transfer (unless the broker & buyer made it part of their agreement).

Average Title transfer service fee is ₱20,000 for properties within Metro Manila and ₱30,000 for properties outside of Metro Manila. The rate typically includes payment for the food & gas of the person doing the transferring. Different brokerages, brokers and Title transfer companies charge different rates.

Tax Chart

Below are the breakdown of the taxes that you will pay when you buy or sell Philippine real estate this 2021.

Do note that some of the taxes and fees differ from location to location.

Remember to double check with your city or municipality’s Registry of Deeds and Assessor’s Office for the exact figure that they will charge you. Most offices have dedicated help hotlines that you could use. Google search the telephone numbers.

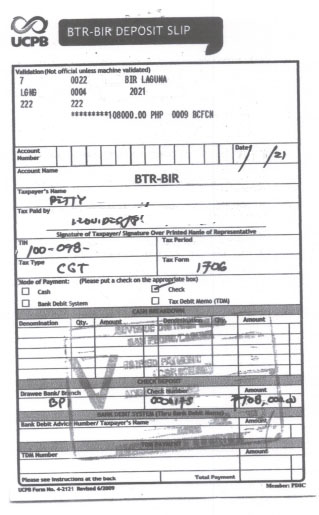

| Taxes | % | Payee |

| Capital Gains Tax | 6.00% | Seller |

| Real Property Tax | 2.00% | Paid & Updated by Seller |

| Documentary Stamp Tax | 1.50% | Buyer |

| Title Registration | 0.25%-0.75% | Buyer |

| Transfer Tax | 0.50% Province – 0.75% NCR | Buyer |

| I.T. Fee | Depends on location | Buyer |

| Notarial Fee | Depends on Notary Public. Commonly 1%-2% | Buyer |

Process of Transferring the Property’s Title

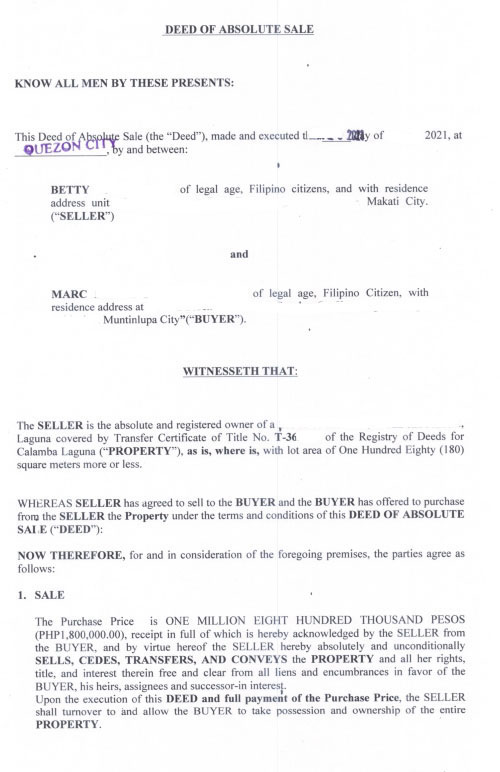

- Buyer & Seller must both sign the Deed of Absolute Sale (DOAS).

Deed of Absolute Sale DOAS. Page 1 - Buyer must have the DOAS Notarized. Different Notary Publics charge varying amounts. Some charge a fixed price while others charge by a percentage, usually 1% to 2% of the selling price.

Seller

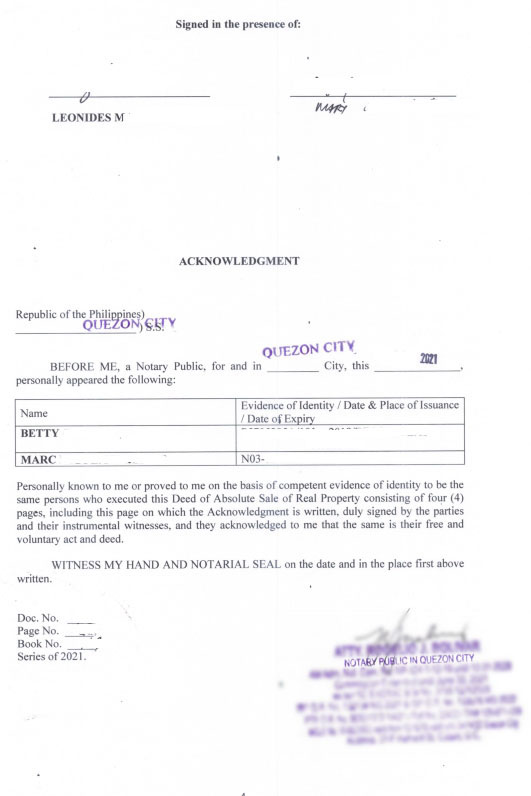

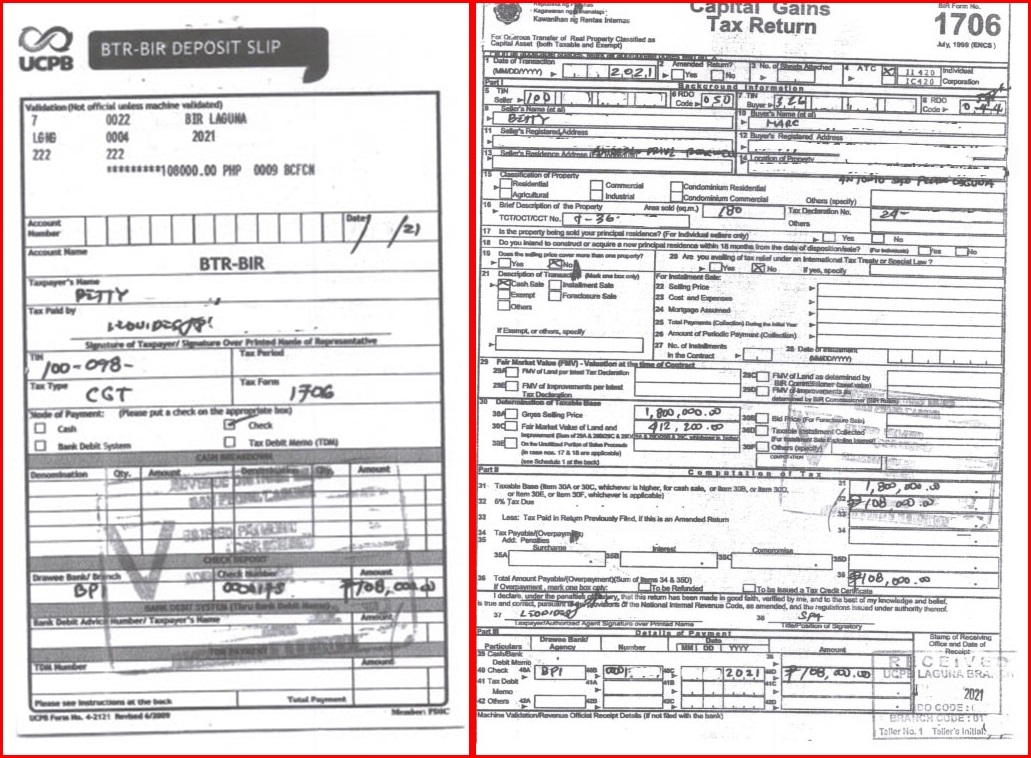

- Seller must fill out and submit the Capital Gains Tax Return (Form 1706) in triplicate (3x) copies, attach the mandatory requirements (see below) and pay the Six percent (6%) Capital Gains Tax (CGT) to the Bureau of Internal Revenue (BIR) Revenue District Office (RDO) or any Authorized Agent Bank (AAB) where the property is covered, within thirty (30) days following the sale of the property.

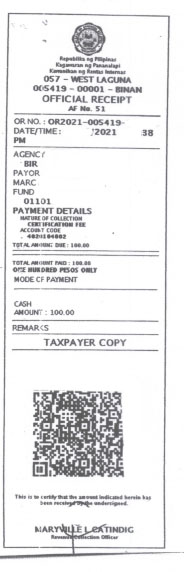

CGT Return. BIR Form 1706. Filled out & Validated . See Authorized Agent Banks here.

Check the Revenue District Office (RDO) of your property here.

Here is the Capital Gains Tax Return (Form 1706) in PDF format that you must fill out.After you have submitted the docs and paid the fees, you need to turnover the Tax Return and payment slip/deposit slip to the Buyer.

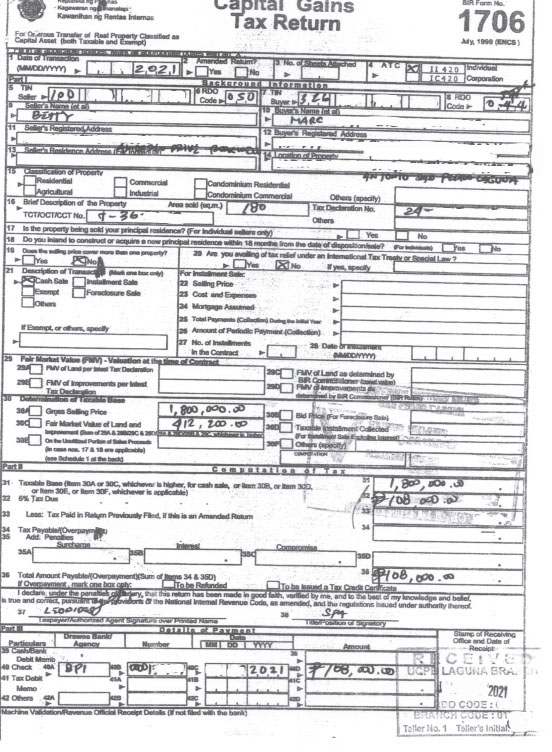

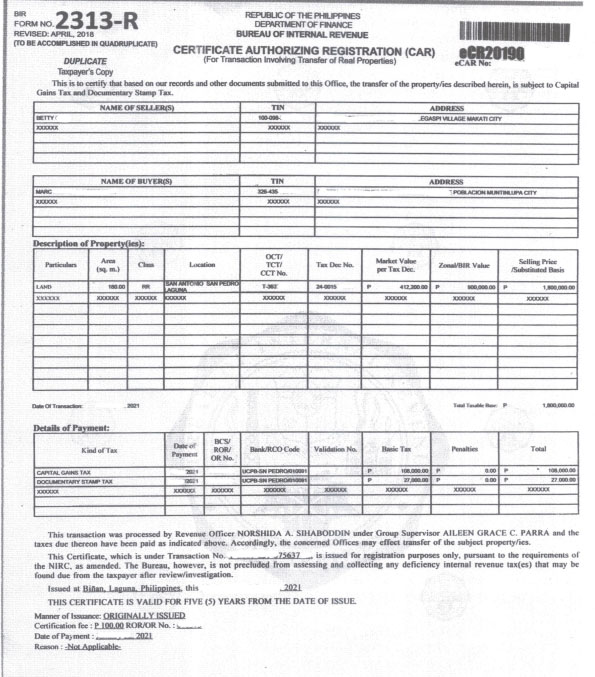

CGT Deposit Slip The Buyer would need these documents to request for the Certificate Authorizing Registration (CAR). The CAR is basically proof that the required tax for the sale of the property has been paid. The Buyer needs the CAR so s/he could transfer the Title to his/her name.

Certificate Authorizing Registration CAR

When and Where to File and Pay

The Capital Gains Tax Return (BIR Form No. 1706) shall be filed and paid within thirty (30) days following the sale, exchange or disposition of real property, with any Authorized Agent Bank (AAB) or Revenue Collection Officer (RCO) of the Revenue District Office (RDO) having jurisdiction over the place where the property being transferred is located.

When the return is filed with an AAB, taxpayer must accomplish and submit BIR-prescribed deposit slip, which the bank teller shall machine validate as evidence that payment was received by the AAB. The AAB receiving the tax return shall stamp mark the word “Received” on the return and also machine validate the return as proof of filing the return and payment of the tax by the taxpayer, respectively. The machine validation shall reflect the date of payment, amount paid and transactions code, the name of the bank, branch code, teller’s code and teller’s initial. Bank debit memo number and date should be indicated in the return for taxpayers paying under the bank debit system.

Filing and payment may also be made using the electronic filing and payment facilities of the BIR (i.e., EFPS/eBIRForms and G-cash, credit, debit card/prepaid card)

For transactions covered by one (1) Deed of Sale/Exchange/Donation involving one (1) to three (3) properties, the taxpayer can avail of the ‘fast lane’ pursuant to Revenue Memorandum Circular (RMC) No. 43-2018, as amended by RMC No. 107-2018. Payments amounting to twenty thousand pesos (P 20,000.00) and below shall be paid in cash while payments above twenty thousand pesos (P 20,000.00) shall be made through Manager’s Check or Cashier’s Check to the RCO of the RDO having jurisdiction over the place where the property being transferred is located.

Mandatory Requirements that should be attached to Form 1706 (You can double-check these at the last page of the Form 1706)

- 1. Copy of the Notarized Deed of Sale or Exchange;

- 2. Photocopy of the Transfer Certificate of Title (TCT), Original Certificate

- of Title (OCT), or Condominium Certificate of Title (CCT);

- 3. Certified True Copy of the latest tax declaration on lot and/or

- improvement;

- 4. If what is sold is lot only, a certification from the Assessor’s Office that

- there is no existing improvement on the property or that the improvement

- is in the name of another;

- 5. Copy of BIR Ruling for tax exemption confirmed by the BIR, if

- applicable;

- 6. Duly approved Tax Debit Memo, if applicable;

- 7. For amended return, proof of tax payment and the previously filed return.

- 8. “Sworn Declaration of Intent” as prescribed in Revenue Regulations 13-99, if the transaction is tax-exempt because the taxpayer falls under boxes 17 & 18. (See Form 1706) These requirements must be submitted upon field or office audit of the tax case before the Tax Clearance Certificate/Certificate Authorizing Registration can be released to the taxpayer.

Buyer

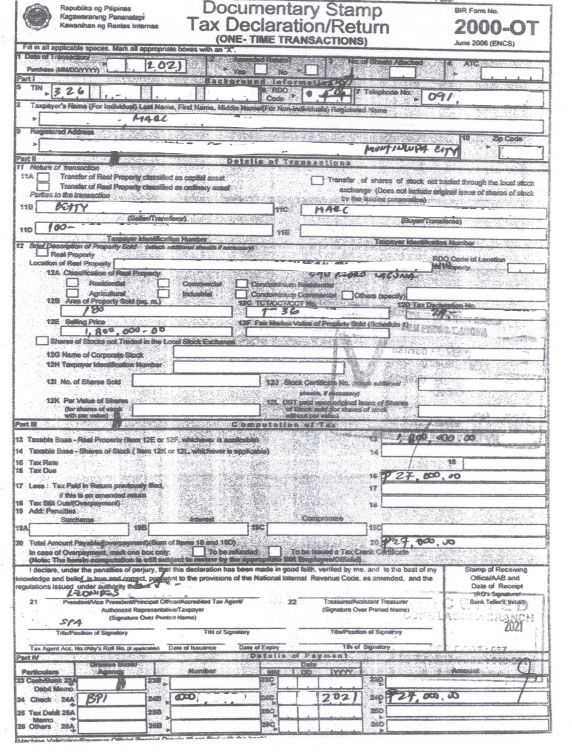

- As the Buyer, you must fill out and submit the Documentary Stamp Tax Declaration/Return – One Time Transactions (Form 2000-OT) and pay one and a half percent (1.5%) Documentary Stamp Tax (DST) to the Authorized Agent Bank or the Bureau of Internal Revenue (BIR) Revenue District Office (RDO) where the property is covered.

DST Declaration Return . BIR Form 2000-OT.

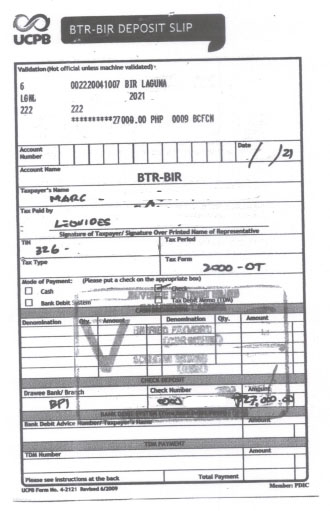

DST Deposit Slip See Tax Code Section 196 for the rate here.

See Authorized Agent Banks here.

Check the Revenue District Office (RDO) of your property here.

Here is the DST Declaration/Return – One Time Transactions (Form 2000-OT) in PDF format that you must fill out & submit.

When and Where to File and Pay

The return shall be filed and the tax paid within five (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred.

The return shall be filed with and the tax paid to the Authorized Agent Bank (AAB) within the territorial jurisdiction of Revenue District Office (RDO) where the seller/transferor/donor is required to be registered or where the property is located in case of sale of real property.

When the return is filed with an AAB, taxpayer must accomplish and submit BIR-prescribed deposit slip, which the bank teller shall machine validate as evidence that payment was received by the AAB. The AAB receiving the tax return shall stamp mark the word “Received” on the return and also machine validate the return as proof of filing the return and payment of the tax by the taxpayer, respectively.

The machine validation shall reflect the date of payment, amount paid and transactions code, the name of the bank, branch code, teller’s code and teller’s initial. Bank debit memo number and date should be indicated in the return for taxpayers paying under the bank debit system.

Payments may also be made thru the epayment channels of AABs or online facility, credit/debit/prepaid cards, and mobile payments.

Payments amounting to twenty thousand pesos (P 20,000.00) and below shall be paid in cash while payments above twenty thousand pesos (P 20,000.00) shall be made through Manager’s Check or Cashier’s Check to the Revenue Collection Officer of the RDO concerned.

Mandatory Requirements for the DST

- Photocopy of the document to which the documentary stamp shall be affixed;

- Proof of exemption under special laws, if applicable;

- Proof of exemption under special laws, if applicable;

- Once the Seller has paid the Capital Gains Tax, ask for the original payment receipt or deposit slip and validated tax return.

- You may now request for the Certificate Authorizing Registration (CAR) from the BIR. Show to the BIR officer or Authotized Agent Bank officer the original copy of the payment receipt or deposit slip and Tax Returns of the CGT & DST.

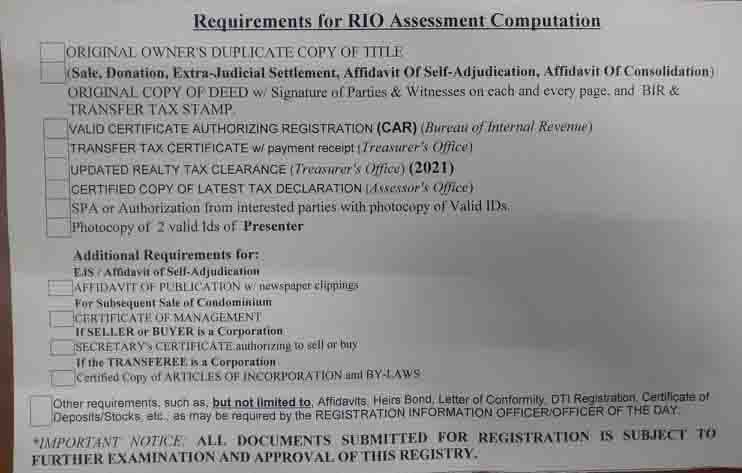

Mandatory Requirements for the CAR

- TIN of Seller/s and Buyer/s ;(One (1) original copy for presentation only)

- Notarized Deed of Absolute Sale/ Deed of Transfer but only photocopied documents shall be retained by BIR; (One (1) original copy and two (2) photocopies)

- Certified True Copy/ies of the Tax Declaration at the time or nearest to the date of the transaction issued by the Local Assessor’s Office for land and improvement; (One (1) original copy and two (2) photocopies)

- Certified True Copy/ies of Original/ Transfer/ Condominium Certificate/s of Title (OCT/TCT/CCT); (One (1) original copy and two (2) photocopies)

- Duly notarized Special Power of Attorney (SPA) from the transacting party/ies if the person signing is not one of the parties to the Deed of Transfer; (One (1) original copy and two (2) photocopies)

- Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued by the Assessor’s Office, if applicable; (One (1) original copy and two (2) photocopies)

- Official Receipt/Deposit Slip and duly validated return as proofs of payment of taxes; (One (1) original copy and two (2) photocopies)

- Secretary’s Certificate or Board Resolution, approving the sale/transfer of the real property and indicating the name and position of the authorized signatory to the Deed of Sale/Assignment, if the seller/transferor is a corporation. (One (1) original copy and two (2) photocopies)

- Read the complete details from the BIR website here.

Certificate Authorizing Registration CAR

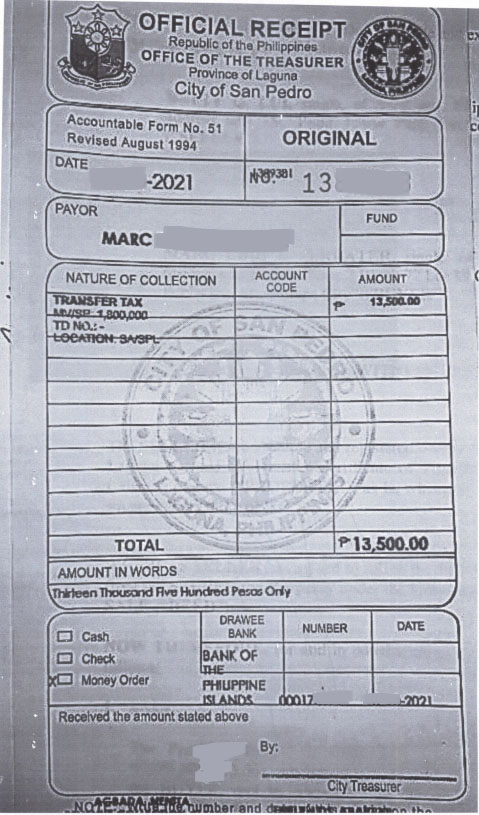

- Pay the Transfer Tax at the Assessor’s Office or City Tresurer, whichever is applicable. The tax rate depends on the location;

- In BGC, it’s 0.60% of the selling price while in other Metro Manila cities its 0.75%.

- Also in BGC, you can pay the Transfer Tax even without the Certificate Authorizing Registration (CAR).

- In Pasig, you are required to have the CAR before being allowed to pay the Transfer Tax.

- You cannot pay the Transfer Tax at the Pasig City Assessor’s Office without the CAR.

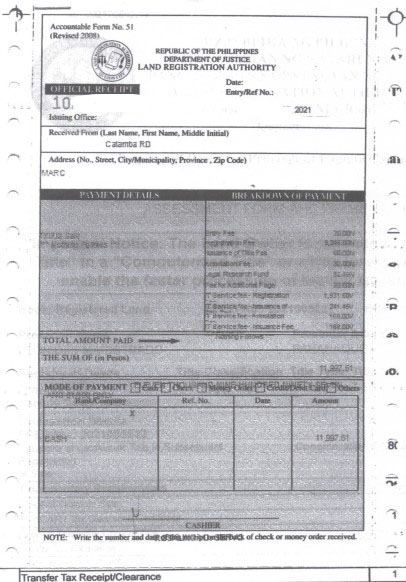

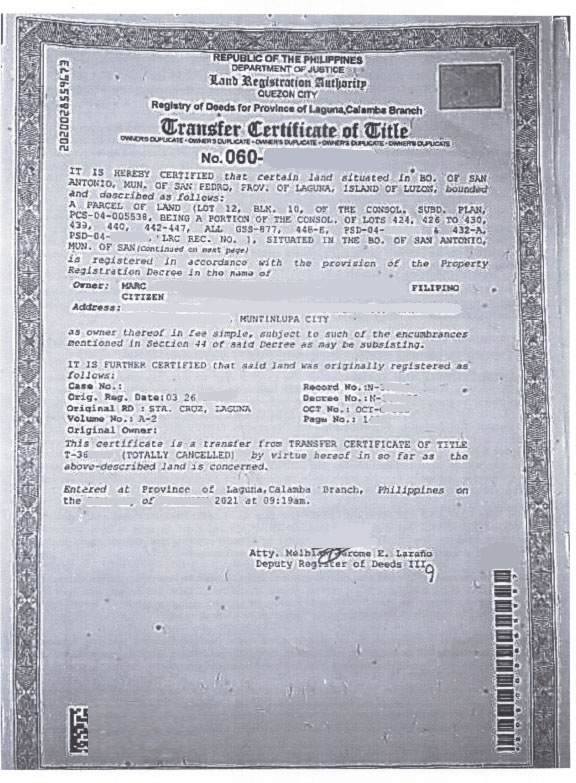

- Pay the Registration Fee and I.T. Fee at the Registry of Deeds or Land Registration Authority, whichever is applicable. Remember, you must have the CAR on hand. After this step, you will just have to wait for the release of the new Title.

Land Registration Authority Registration & IT Receipt - You cannot pay the Registration Fee and I.T. Fee at the Pasig City Registry of Deeds without the Transfer Tax Certification from Assessor’s Office-Treasury Department. See sample below.

- It would cost you ₱200.00. A sample of the Pasig City Transfer Tax Certification can be seen below.

Transfer Tax Certification from Assessor’s Office-Treasury Department

- Once the new Title has been released by the Registry of Deeds, go back to the Assessor’s Office and submit the following:

- New Title

New Title already in the name of the Buyer. - CAR

- Verified Copy of the Title (issued by the Registry of Deeds)

- Tax Clearance (issued by the Assessor’s Office)

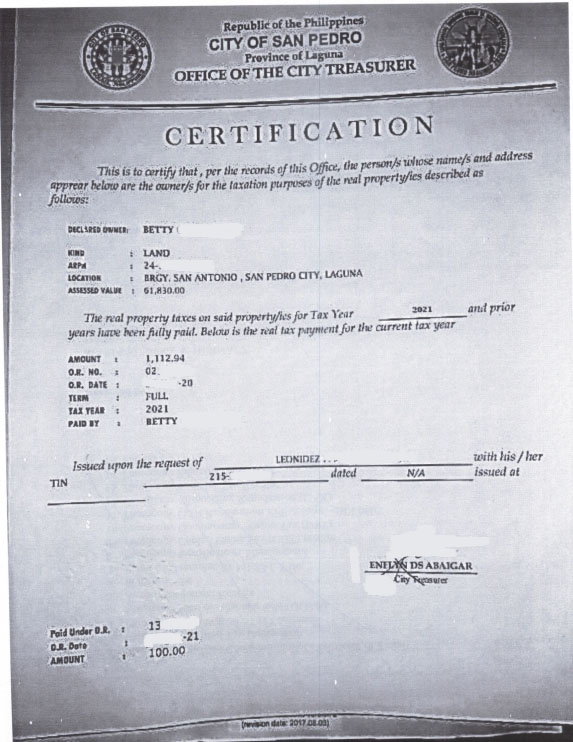

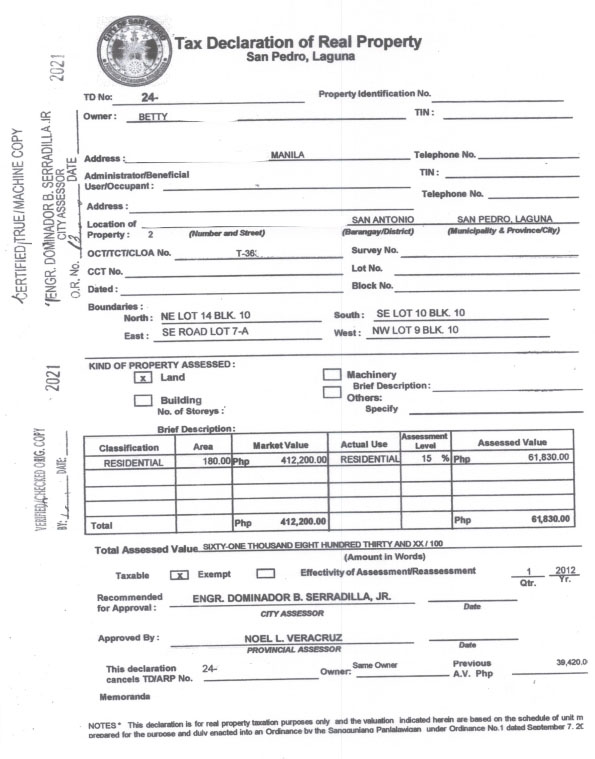

City Treasurer Tax Certification or Tax Clearanace - Verified Copy of the Tax Declaration of the Seller. Remember, the Tax Declaration must be still in the name of the Seller. (this is issued by the Assessor’s Office)

Tax Declaration of the Property that is still in th name of the Seller.

- New Title

- After you have submitted the documents above, you may now request from the Assessor’s Office your new Tax Declaration that would already reflect your name (as the new owner).

- If the property is located in Calamba, Laguna:

- To request for the new Tax Declaration, you must submit a Verified Copy of the new Title that’s already under your name (as the new owner).

- Without the Verified Copy, the Assessor’s office will reject your request of the new Tax Declaration.

Done

I know. I know. The task is quite confusing and daunting specially for first timers. It took me three days just to organize my thoughts and prepare the materials for this piece and I already skipped enumerating the minute details at that!

Regardless of the difficulty of the task, you have to do what you have to do, right? If you don’t pay the taxes or transfer the Title on time, you’ll be in for quite a headache.

The easiest way to do all of this, if you have extra money laying around (of course), is to simply pay a PRC licensed real estate brokerage, broker, agent or Title Transfer company to do the job for you. Someone that you would absolutely trust.

Good luck and be safe!